THIS IS YOUR BUSINESS GROWTH

FUELLING TOWNSHIP ENTREPRENEURSHIP.

Sawubona! Welcome to SUM1 LOANS, the smartest way to grow your business.

HELLO!

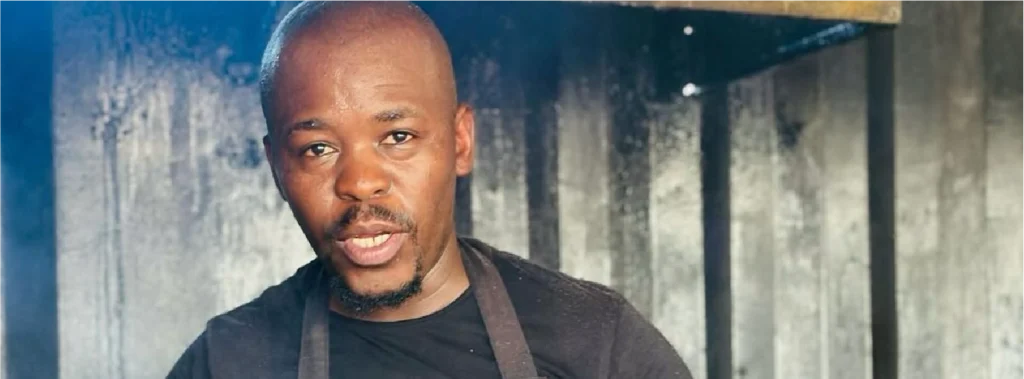

I'M MOO'LA, YOUR FRIEND IN MONEY.

I'm here to make saving feel less like hard work and more like a conversation.

CELEBRATION NATION

YOUR NEXT BIG SMILE IS JUST A FEW CLICKS AWAY.

Ask Naledi and Zinhle why they're smiling? They grew their business powered by SUM1.

1 | 3